Venture Capitalist

Pioneer Ecosystem and Venture Capital Industry developer in Latin America, Lisandro and his leadership team has taken seed investments to IPOs. He is a Co-founder of Endeavor Argentina (first Endeavor in the world), now in 45 markets with 50 unicorns. Starting in 2023, Lisandro now has created Oikos Capital, to lead deep tech impact investing in the bioeconomy (climate, agrifood) value chains for food security and sustainable development. By linking innovation hubs from the Americas with the Middle East and Global Markets through a new fund, Oikos Capital.

Lisandro is a Bachelor Economics in Argentina (Suma cum Laude) and an MPA Graduate in Harvard Kennedy School.

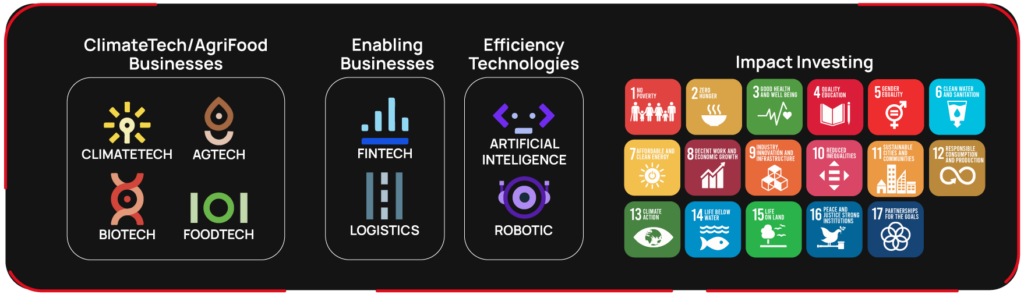

Oikos fund invests in technology companies that have significant impact in the efficiency of all the food production value chain

From the table to the farm

Venture Capitalist

Pioneer Ecosystem and Venture Capital Industry developer in Latin America, Lisandro and his leadership team has taken seed investments to IPOs. He is a Co-founder of Endeavor Argentina (first Endeavor in the world), now in 45 markets with 50 unicorns. Starting in 2023, Lisandro now has created Oikos Capital, to lead deep tech impact investing in the bioeconomy (climate, agrifood) value chains for food security and sustainable development. By linking innovation hubs from the Americas with the Middle East and Global Markets through a new fund, Oikos Capital (link to Oikos).

Oikos fund invests in technology companies that have significant impact in the efficiency of all the food production value chain

From the table to the farm

Oikos fund invests in technology companies that have significant impact in the efficiency of all the food production value chain

From the table to the farm

Venture Capitalist

Pioneer Ecosystem and Venture Capital Industry developer in Latin America, Lisandro and his leadership team has taken seed investments to IPOs. He is a Co-founder of Endeavor Argentina (first Endeavor in the world), now in 45 markets with 50 unicorns. Starting in 2023, Lisandro now has created Oikos Capital, to lead deep tech impact investing in the bioeconomy (climate, agrifood) value chains for food security and sustainable development. By linking innovation hubs from the Americas with the Middle East and Global Markets through a new fund, Oikos Capital (link to Oikos).

Lisandro is a Bachelor Economics in Argentina (Suma cum Laude) and an MPA Graduate in Harvard Kennedy School.

Track Record

Lisandro led the Series A of USD $1M as follow up of Holdinvest Tech Fund/Axia Ventures. In 2017 he led the Series B round of US$ 13 Million, with his Alta Ventures fund co-investing with Kaszek, Intel Capital (Oria Capital), and Endeavor Catalyst. Technisys followed the Series C Round led by Riverwood in 2019, and exit thru SOFI at US$ 1,1 Billion in March 2022.

46.5x DPI in Axia Ventures investment and 6.5x DPI in Alta Ventures investment.

Their product consists of a small card reader device that can be connected to a mobile device, allowing merchants to securely process payments on the go. Co-Investors: American Express Ventures, Sierra Ventures, Accion; Follow-on: General Atlantic, Goldman Sachs. In 2023, Clip reached an agreement with Morgan Stanley to finance the company until IPO readiness.

9.81x TVPI by Alta Ventures.

The use of enzymes for large-scale industrial processes is the fundamental cornerstone of modern green chemistry technologies. Co-investors: Ax Ventures-Pymar Fund LP. Lead investors were Fundacion Empresa y Crecimiento (Ana Patricia Botín of Santander Bank) COFIDES from Spain, FOMIN/Interamerican Development Bank-IDB Labs. CAF Latin American Development Bank and Argentine Family Offices.

5x TVPI.

Additionally, they offer integrated payment solutions, logistics services, and advertising tools to support sellers and enhance the overall shopping experience. Lisandro was the CEO of i5-Hicks Muse Tate & First Venture Capital investment company that co-invested with Chase Capital Partners in the first institutional Series A round. Follow-on rounds added JP Morgan and Goldman Sachs.

13x DPI in Hicks Muse Tate & First and current market cap of ~$80 Bn.

As a one-stop platform, Despegar.com enables users to book flights, hotels, vacation packages, car rentals, and other travel-related services. Their advanced technology seamlessly connects travelers with a vast network of suppliers, allowing for real-time availability, competitive pricing, and personalized recommendations.

1.25x DPI.

In 1999, Cemtec (Cemex Mexico) put an offer that bought Angels, and Hicks got a Put Option for US$ 30 Million company Valuation. In 2022 Cemex left control and Advent PE joined Neoris (link).

7.5x DPI.

Who dream bigger, scale faster, and pay it forward, to build thriving entrepreneurial ecosystems in emerging and underserved markets around the world.Lisandro was co-founder of Endeavor Argentina together with Eduardo Elsztain, Woods Staton, Santiago Bilinkis, Maria Eugenia Estenssoro, Oscar Toppelberg, Carlos Adamo, and Andy Freire. Endeavor is currently in 45 markets. Its Endeavor Catalyst Fund has invested in 45 unicorns, very active in Latin America and in the Middle East. For example Endeavor Jordan, Endeavor Saudi Arabia, and Endeavor Egypt.

$50 Bn in revenues generated by Endeavor Entrepreneurs.

4.1 M jobs created.

Venture Capital by Lisandro

Ecosystem

Citizenship

Club of Rome Forum Human Project (Rome 84 y 79)

Aurelio Peccei, Founder and Chairman of the Club of Rome, promoted the Forum Humanum Project, which the Swiss Migros Foundation financed. 30 young people in their late twenties to early thirties assembled to discuss the Agenda of Global Issues to understand and influence global and local policies. Lisandro Bril was co-coordinator of the Argentinean team, which was coached by Carlos Mallman

Club of Rome Forum Human Project (Rome 84 y 79)

Aurelio Peccei, Founder and Chairman of the Club of Rome, promoted the Forum Humanum Project, which the Swiss Migros Foundation financed. 30 young people in their late twenties to early thirties assembled to discuss the Agenda of Global Issues to understand and influence global and local policies. Lisandro Bril was co-coordinator of the Argentinean team, which was coached by Carlos Mallman

Timeline

2023

2017

1998

1993

1984 - 1979

1983

Biography

Lisandro is the Founder and General Partner of Oikos Fund LP with focus in Deep Techs ( AI, Robotics, Cyber, Quantum) applied to Disrupt Clima Agri Food Techs global value chains

Oikos is implementing a Cross Border Approach to address the Climate and Food Security Agenda

Oikos connects Latin America, with Capital of the GCC Countries and deploying global market “table to the farm” solutions

In Venture Capital Seed, Series A and Growth Rounds

This is Lisandro´s fifth Venture Capital Fund. Currently with US$ 125 Million of ASUM in AltaVentures, a Pan-American VC Fundand AxiaVentures Company Builder. He is an LP in J-Ventures Impact Investing Silicon Valley based fund and CoFounder ofits Latin American Community. Combined track record of Lisandro’s Funds has been x 4 Cash on Cash for investors His career in Venture Capital and high impact entrepreneurial development started as a pioneer during the 90s as Angel investor in Graphical Information (Executive Support System sold to Oracle), and in Amtec (now NEORIS).

In 1998, he co-founded the BGS Seed Capital Fund in Latin America (Argentina, Brazil, Mexico and Venezuela) and was CEO of i5/HicksFund in Argentina, with US$ 20 Million invested in Mercado Libre (IPO MELI:Nasdaq), Despegar (IPO DESP: NYSE) , andAmtec (Exit to Neoris). He was the lead investor in Technisys Series A and B rounds (Exit to SOFI in March 2022 at US$1,1 Billion. While Clip (Mexico) and Mural (USA & Argentina) became Unicorns in 2021

Lisandro has co-created and has worked as Member of the Advisory Board and Investment Committee of CITES of Sancor Insurance Group, the first Science Tech based incubator of Latin America, based in Santa Fe & Bariloche – Argentina – and Uruguay

CITES implemented the Science Tech Israeli Incubator model. He is a pioneer of the Latin American entrepreneurial ecosystem since the early 90s

Co-founder of Endeavor Argentina (first Endeavor in the world that promotes hi impact entrepreneurs ) Judge at the Annual Harvard Business School Business Plan Competition, as well as at the MIT Latin America 50K. Active “Ambassador” of the Annual Punta del Este Uruguay Meet up, the first Entrepreneurs and Investors Latin American annual summit founded by Sergio Fogel (also J-Ventures LP) and Pablo Brenner .Thru his different investment vehicles , Lisandro is a CoFounder of the ARCAP venture capital association of Argentina (2009) , Became the first Latin American member of the Middle East Venture Capital Association – MEVCA- (2023)

The Latin American VentureCapital Association -LAVCA- (2010) He is also an active Member of the recently created Uruguay Venture CapitalAssociation – URUCAP- (2023) Prior to his VC career, , Lisandro founded Booz Allen Hamilton in Argentina, and was its Managing Director.

He retired as Chairman of the BAH Advisory Board. He also worked for seven years as Partner at both Spencer Stuart and Korn/ Ferry International Management Consulting and Executive Search Firms. Lisandro has experienced an active public government and civic participation. He was the UnderSecretary of Industry & Foreign Trade of Argentina (1985-88)

Co-founder of ConstiTuya, a network of Argentine non-partisan citizens that has the purpose of creating public goods and foster state policies for ESG-compliant social and economic development. Co-Founder and Treasurer of the Education NGOs Fundación Equidad and Fundación Luminis, Member of the Advisory Board of CIPPEC (G20 Argentine organizer think tank). President of Harvard Club Argentina. Board Member of Foreign Trade Commission of the American Chamber of Commerce in Argentina (AmCham). Lisandro was as at the foundation stages of the G50 Group, Washington Carnegie Endowment for International Peace Latin American business leaders organization (1995)

Economic Journalist &Chief Division of Publications of the InterAmerican Development Bank – INTAL-

Case Writer at the Harvard Business School. Lisandro holds a BA in Economics (Summa Cum Laude) from University of Buenos Aires, and an MPA from Harvard John F. Kennedy School of Government with major in Government Policies & and Business. He is the father of Tomas, Andrea and Alex.

An active Photographer and Transmedia Producer. Avid traveler and knowledge capital transfer player.

He was born and is a fiscal resident of Argentina, and has recently established his home in Patagonia and Montevideo.